Crispin T. South has published “Let Them Be Tribal Members: Exempting Nonmember Resident Indians from State Taxes” in the Arizona State Law Journal. Here is the abstract:

Under McClanahan v. Arizona State Tax Commission, States are categorically preempted from taxing the income of an Indian who lives within his own Tribe’s reservation and gains his income from reservation sources. Later cases have distinguished McClanahan, holding that the income of Indians who live and work within a different Tribe’s reservation is generally taxable by the State. State income taxation of these non-member resident Indians poses a number of problems for individuals, Tribal governments, and tribal sovereignty as a whole. This Comment argues that to push back against these problems, Tribes ought to enter into membership reciprocity agreements that allow non-member resident Indians to become Tribal members, thus exempting them from state income taxes under McClanahan’s categorical rule.

Emiliana Almanza Lopez has published “Tribal Sovereignty, Sales Tax, and States Interference: Why Tax Compacts May Be the Best Way Forward” in the Minnesota Journal of Law & Inequality. Here is the abstract:

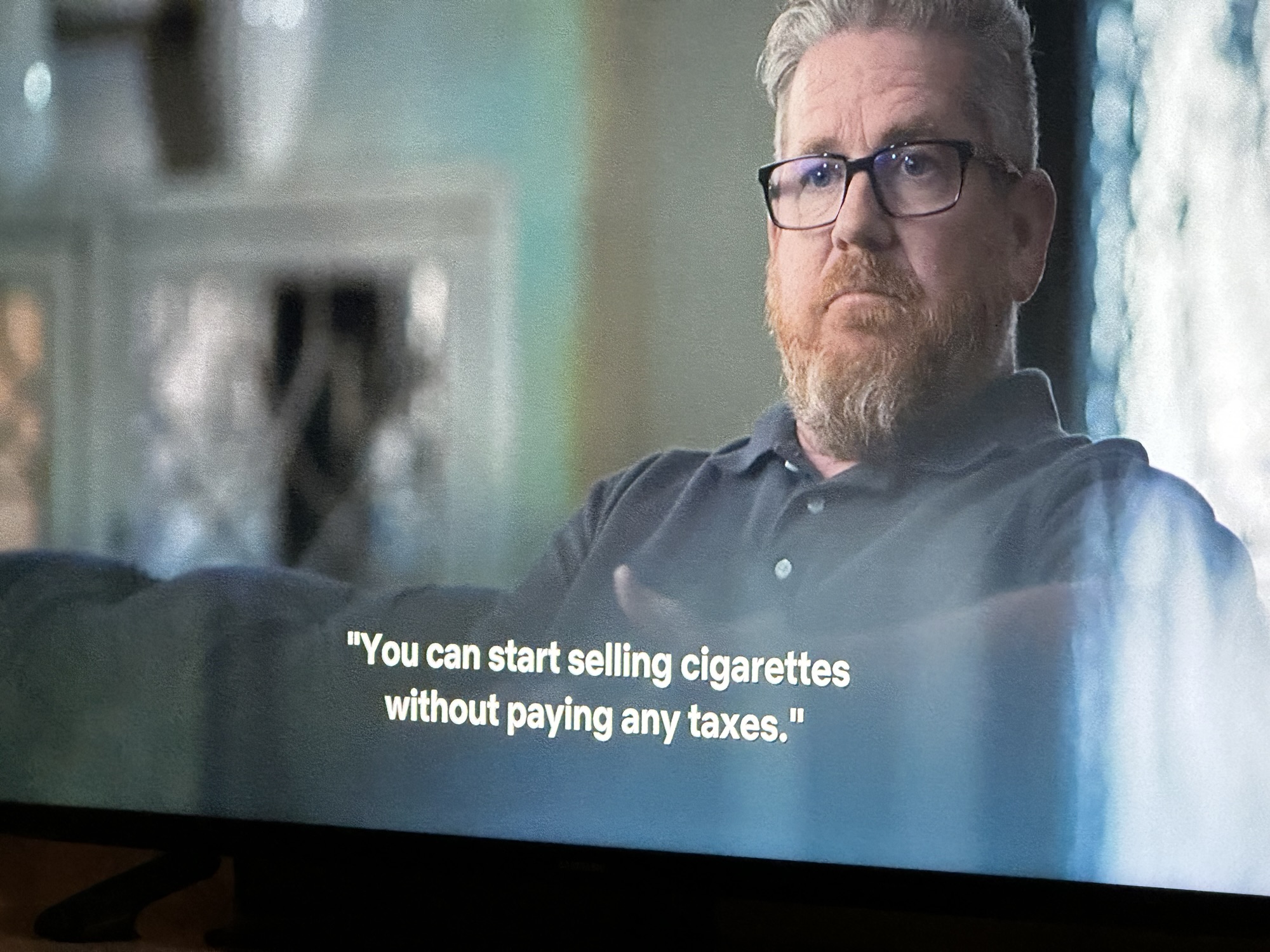

Tribes as sovereigns have the power of taxation. When states seek to impede this power by imposing their own taxes on non-member transactions on Reservations, Tribes must decide if imposing their own Tribal tax outweighs the risk of increased prices deterring business and business partnerships. This is the issue of double taxation. This Note investigates paths of remedy that address the burden of double taxation specific to sales taxes. Specifically, it looks at tax preemption, litigation, and policy. Preemption is difficult, and the existing case law framework on state tax preemption in Indian Country is complex, fact specific, and generally favors the state. Current federal policies fail to address this issue, and states are unlikely to preempt their own taxes without gaining something in return. Tribe-state tax compacts offer a compromise that releives some of the burden borne by Tribes, but also requires concessions. This Note argues that while imperfect, these tax compacts may be the best remedy to double taxation in Indian Country and offers suggestions for how these binding agreements between sovereigns can be used to enforce state respect for Tribal sovereignty.

You must be logged in to post a comment.