Here are the opinions in Stroble v. Oklahoma Tax Commission:

Briefs here.

Here are the opinions in Stroble v. Oklahoma Tax Commission:

Briefs here.

Here is the petition in South Point Energy Center LLC v. Arizona Dept. of Revenue:

Lower court materials here.

Order list here.

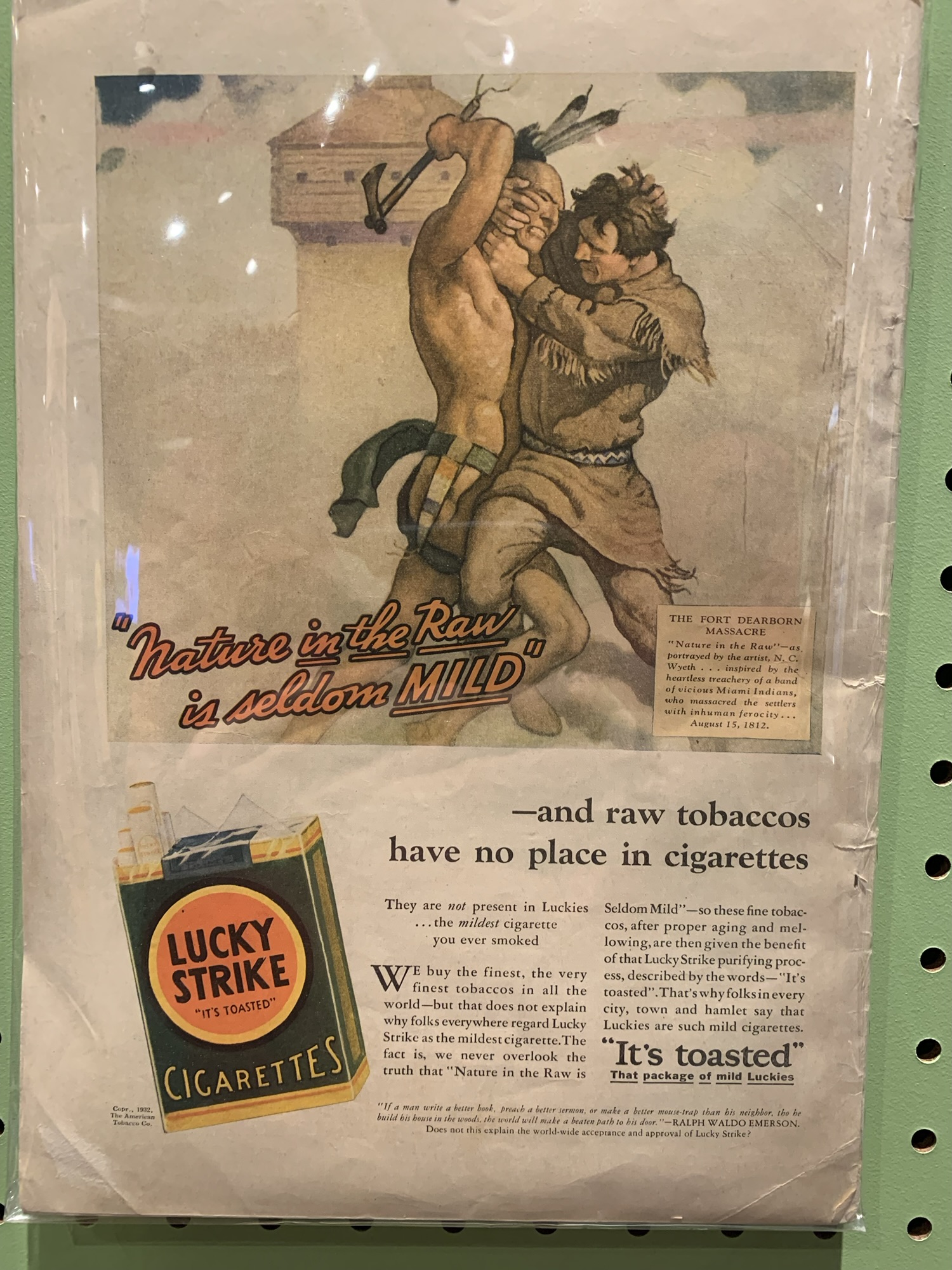

Just goes to show that there really is no opportunity for Indian people or tribal nations to persuade the federal judiciary to correct its past mistakes. There is no room for long-term litigation strategies.

Petition here.

Here is the petition in HCI Distribution Inc. v. Hilgers:

Questions presented:

I. Under this Court’s decision in California v. Cabazon Band of Mission Indians, 480 U.S. 202 (1987), may a state directly regulate commerce between tribal economic development entities on the tribe’s own reservation lands without a showing of exceptional circumstances?

II. In conducting the balancing test under White Mountain Apache Tribe v. Bracker, 448 U.S. 136 (1980), may a court discount a tribe’s interests in self-determination and self-sufficiency based upon the court’s view of the significance of the tribe’s economic development activities?

III. Did the Eighth Circuit’s modification of the District Court’s injunction effectively rewrite Nebraska’s escrow and bond statutes, substituting the court’s decision for that of the state legislature, in violation of the standards set forth in Ayotte v. Planned Parenthood of New England, 546 U.S. 320 (2006) and other precedents of this Court?

Lower court materials here.

Here are the new materials in State of California v. Del Rosa (E.D. Cal.):

You must be logged in to post a comment.