Here:

IRS Finalizes Tribal General Welfare Benefits Rule

Here:

Here:

Here is the complaint in Sovereign Iñupiat for a Living Arctic v. Burgum (D. Alaska):

Here are relevant materials in United States v. Bullhead (D. Minn.):

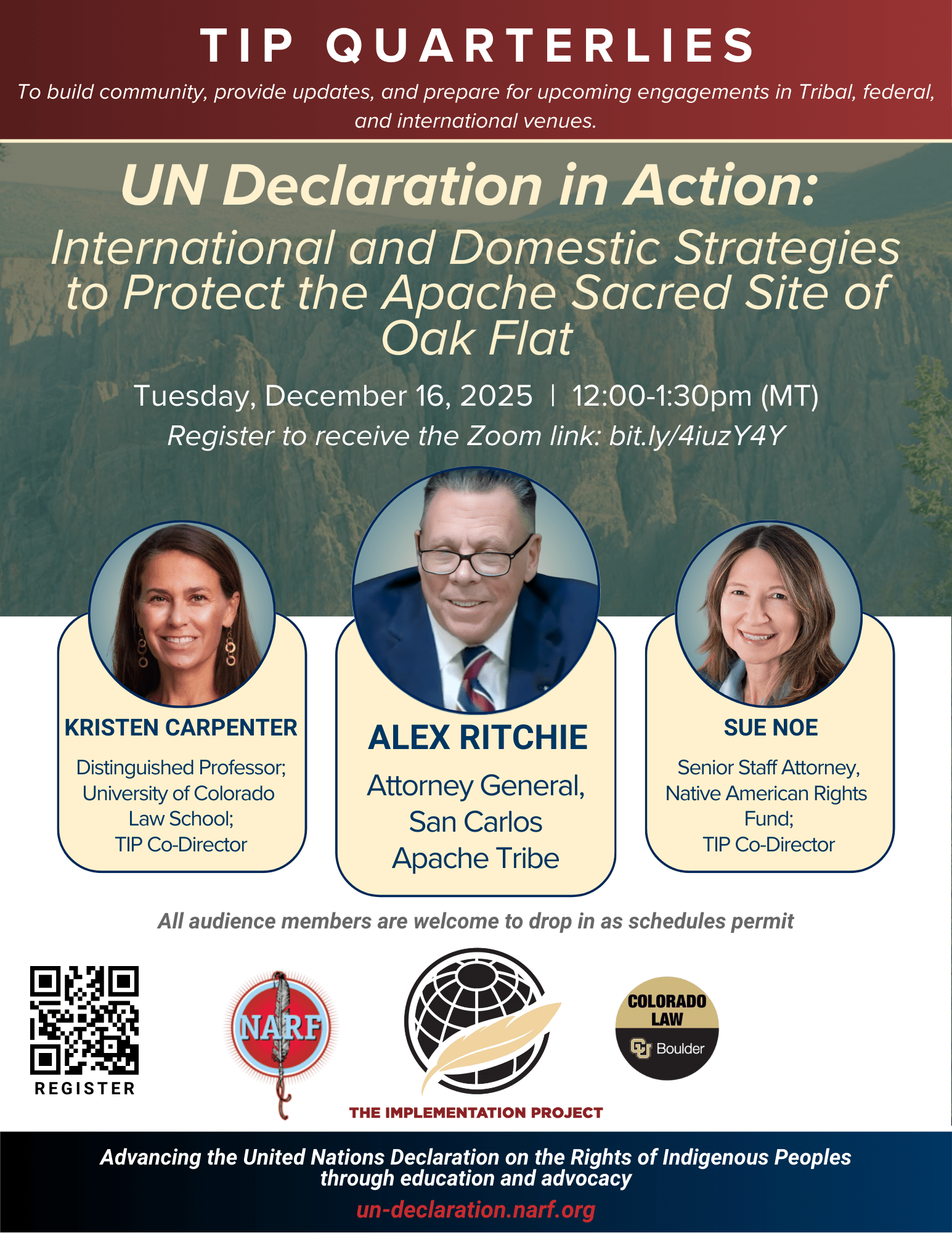

Register here.

The Implementation Project will be hosting the next TIP Quarterly Meeting on December 16, 2025 from 12:00-1:30 PM (Mountain Time).

“UN Declaration in Action: International and Domestic Strategies to Protect the Apache Sacred Site of Oak Flat” will feature Mr. Alex Ritchie, San Carlos Apache Tribe Attorney General. Join us to explore the ongoing efforts to defend Oak Flat and the role the UN Declaration on the Rights of Indigenous Peoplesplays in shaping these strategies. This webinar will offer valuable insights for anyone interested in Indigenous rights, cultural preservation, or Tribal advocacy. Moderated by TIP Co-Directors: Prof. Kristen Carpenter and Ms. Sue Noe.

You must be logged in to post a comment.